Pitchforks and slopes are powerful tools that traders can use to make sense of trending markets. These tools can help identify price channels and give structure to a market advance or decline. As a result, they offer reaction zones and potential trading opportunities that traders can take advantage of.

Understanding pitchforks in trading is essential for traders who want to make sharp trades and maximize their profits. Pitchforks were developed by Dr. Alan Andrews as a basic trend tool that identifies price channels. They consist of three parallel lines that are drawn to connect significant highs or lows in a chart. The middle line is the median line, which represents the average price of the trend. The other two lines are called the upper and lower parallel lines, which are drawn equidistant from the median line.

Applying slopes and pitchforks to your trading strategy can help you identify hidden levels of support and resistance. By identifying these levels, you can make more informed trading decisions and increase your chances of success. Whether you’re a seasoned trader or just starting, learning how to trade with pitchforks and slopes can help you take your trading to the next level.

Key Takeaways

- Pitchforks and slopes are powerful tools that traders can use to make sense of trending markets.

- Understanding pitchforks in trading is essential for traders who want to make sharp trades and maximize their profits.

- Applying slopes and pitchforks to your trading strategy can help you identify hidden levels of support and resistance.

Understanding Pitchforks in Trading

Pitchfork trading is a popular technical analysis strategy that helps traders identify potential levels of support and resistance in financial markets. A pitchfork is a charting tool that consists of three parallel lines that help traders identify potential price channels. The median line of the pitchfork is the most important line, as it represents the trendline of the market.

The Basics of Pitchfork Trading

To use pitchforks in trading, traders must first identify an anchor point. This is the starting point for drawing the pitchfork. Once the anchor point is established, traders can draw the pitchfork by connecting the anchor point with two other points on the chart. The two outer lines of the pitchfork are drawn parallel to the median line, creating a channel that traders can use to identify potential levels of support and resistance.

Setting Up Your Pitchfork

To set up a pitchfork, traders must first identify the anchor point. This is typically a high or low that has previously occurred on the chart. Once the anchor point is identified, traders can draw the pitchfork by connecting the anchor point with two other points on the chart. The two outer lines of the pitchfork are drawn parallel to the median line, creating a channel that traders can use to identify potential levels of support and resistance.

Interpreting Pitchfork Signals

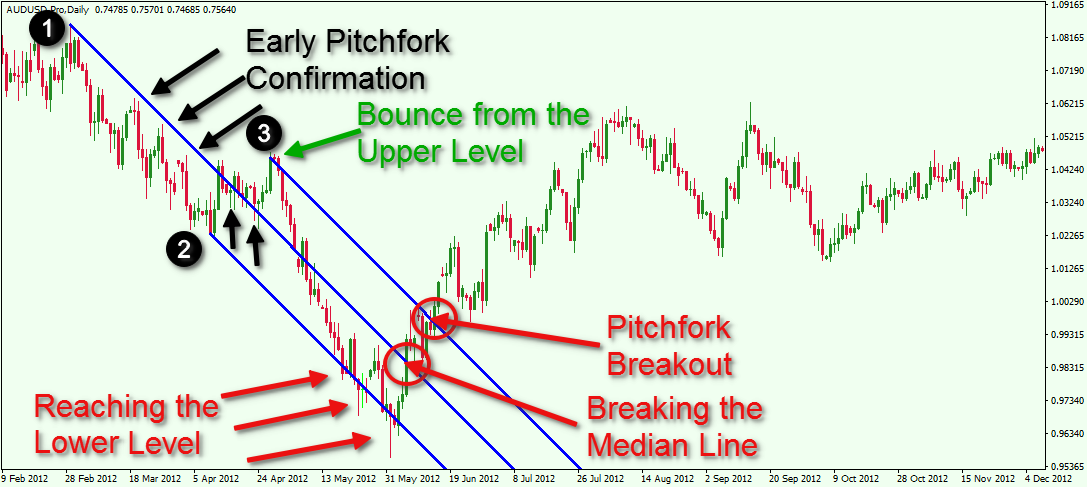

Pitchforks can be used to identify potential levels of support and resistance in financial markets. When the price of an asset is trading within the channel created by the pitchfork, traders can use the upper resistance and lower support lines as potential levels to enter or exit trades. Breakouts above the upper resistance line or below the lower support line can be used as potential signals that the market is trending in a new direction.

Traders can also use pitchforks to identify potential retracements in the market. When the price of an asset retraces to the median line of the pitchfork, traders can use this as a potential signal that the trend is still valid. Confirmation of the validity of the trend can be seen when the price bounces off the median line and continues to move in the same direction.

Overall, pitchforks are a useful technical analysis tool that can help traders identify potential levels of support and resistance in financial markets. By understanding how to set up and interpret pitchforks, traders can improve their trading strategies and make more informed trading decisions.

Applying Slopes and Pitchforks to Your Trading Strategy

Pitchforks and slopes are powerful technical tools that can be integrated into a trader’s strategy to identify profitable opportunities in the market. When used in conjunction with other technical indicators, they can provide a clear picture of market trends and help traders make informed decisions.

Integrating Pitchforks with Other Technical Tools

Pitchforks can be integrated with other technical tools such as Fibonacci retracements, trendlines, and price oscillators to identify potential trade setups. Traders can use the pitchfork to identify levels of support and resistance and set stop-loss orders accordingly. By combining pitchforks with other tools, traders can increase the accuracy of their trades and minimize their risk.

Risk Management and Trade Execution

Risk management is a crucial aspect of trading, and pitchforks can help traders manage their risk by identifying potential reversal points. Traders can use the pitchfork to identify false breaks and reversals, and set targets accordingly. By using pitchforks in conjunction with other technical tools, traders can improve their trade execution and minimize their risk.

Advanced Pitchfork Techniques for Experienced Traders

Experienced traders can use advanced pitchfork techniques such as Schiff and modified Schiff pitchforks to identify potential trade setups. These techniques can help traders identify divergences and trade with confidence. By mastering advanced pitchfork techniques, traders can take their trading to the next level and achieve greater success in the market.

In conclusion, pitchforks and slopes are powerful technical tools that can be integrated into a trader’s strategy to identify profitable opportunities in the market. By combining pitchforks with other technical tools, traders can improve their trade execution and minimize their risk. With advanced pitchfork techniques, traders can take their trading to the next level and achieve greater success in the market.