Forex trading has many strategies and scalping stands out as a popular method for traders who thrive on quick and small gains. Scalping involves opening and closing multiple positions over short time frames, spanning mere minutes or even seconds. To succeed in forex scalping, traders must leverage specific tips and technical indicators. This article delves into the best tips and indicators for enhancing your forex scalping strategy.

Summary:

- Scalping is the strategy of making loads of small days throughout the day to make an overall net profit.

- This strategy is very fast paced and requires immense focus. There are times for optimal uses but you should always consider your risk management while placing a trade.

- There are several trading indicator methods that you can use to enhance scalping such as: Moving Average Ribbon Strategy; Bollinger Bands; Stochastic Oscillator; Parabolic SAR and Relative Strength Index.

- These indicators can be merged for a more effective trading plan and allow you to adapt to modern market conditions.

What is scalping?

The main purpose of forex scalping is to collect many small profitable trades that accumulate into a significant number of pips throughout the course of the day. Scalping takes advantage of the fact that small market moves occur much more frequently than larger ones, especially within the more stable sections of the trading day. Trades using scalping strategies are often intensive as they require laser focus on the charts for several hours.

Here are some of the key features of scalping:

- High Trade Volume: Each trade aims to make a small profit of a mere few pips, although these collect across hundreds of trades throughout a day.

- Short holding period: trades are held for a very short period, usually a few minutes or even seconds, so that the traders can capitalise on minor price movements.

- Daily Closure: traders reduce risk exposure by closing all trades by the end of the trading day.

- High focus and demanding decision-making.

Key tips for Forex Scalping:

1. Focus on major pairs.

Major currency pairs like EUR/USD, GBP/USD, and USD/JPY provide high liquidity and tighter spreads, perfect for scalping.

2. Using a reliable broker.

Ensuring that brokers offer fast execution speeds and low spreads allowing high-frequency trades without frequent downtimes or technical glitches.

3. Employ Risk Management.

Utilise stop-loss orders to minimise potential losses while also only trading around 1-2% of your capital. This approach prevents significant losses that can be accumulated from numerous small trades.

4. Trade During Peak Times

Some of the best peak trade times happen around the London and New York sessions overlap. This period has the most frequent price movements which is ideal for scalping strategies.

5. Keep Positions Short

Hold trades for short time periods to avoid prolonged exposure to market fluctuations as the aim is to only capture SMALL price movements that occur throughout the day.

6. Staying disciplined and avoiding overtrading.

Sometimes it can be hard to avoid the temptation and focus on greed and the pursuit of profit. However, overtrading is very risky as it can lead to significant losses. Some days trades are continually unsuccessful and so showing self-discipline and knowing when to stop can be very beneficial for traders.

7. Monitor Economic Calendars.

Being conscious of economic events and news and how these can impact prices and cause market volatility.

Indicators for Forex Scalping:

Moving Average Ribbon Entry Strategy:

Method: Apply a 5-8-13 simple moving average (SMA) combination on a two-minute chart.

This technique analyses the 5th bar, the 8th bar, and the 13th bar in 2-minute chart graphs. If these bars all show a strong uptrend, then it is best to look for buying opportunities. Traders should identify strong trends within these bars to determine wherever to buy or sell on short counter swings. Looking at the 13-bar can indicate waning momentum and signal a potential range or reversal in the short-term charts.

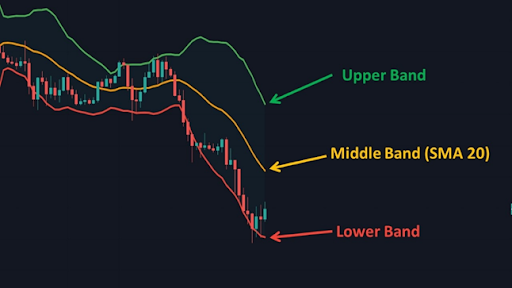

Bollinger Bands

Method: Apply a 20-period SMA with 2 standard deviations above and below.

This is a popular technical analysis tool that looks at a 20-period simple moving average (SMA) with bands set at 2 standard deviations above and below the SMA. These bands serve as dynamic levels of support and resistance as if the price touches the upper band, it suggests that the asset may be overbought which signals a potential selling opportunity. Similarly, if the price hits the lower Bollinger Band and then starts to rise, it could indicate an oversold condition and a potential buying opportunity.

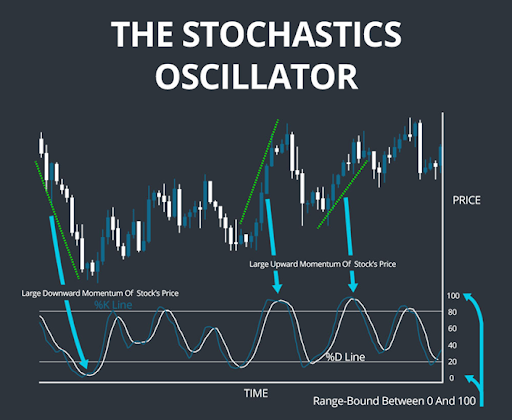

Stochastic Oscillator

Method: Use the 5-3-3 setting for quick signals.

This setup helps detect potential reversals in trends by analysing the momentum of price movements. A buy signal is generated when the %K line crosses above the %D line in the oversold area, indicating the asset may be undervalued and ready for a price increase.

Parabolic SAR (Stop and Reverse)

Method: Involves applying the settings of 0.02 step and 0.2 maximum.

When the dots appear below the price, this indicates an uptrend so you should consider buying while the dots appearing above the price indicates a downtrend. These dots appear above or below to indicate the trend suggests selling or buying.

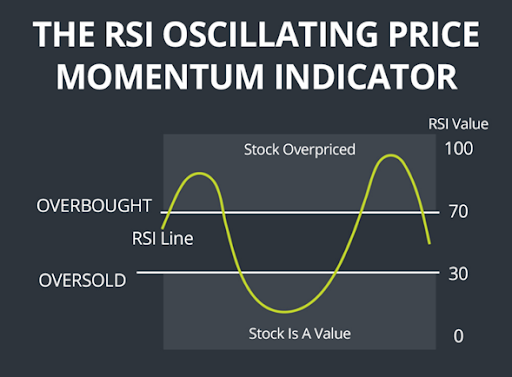

Relative Strength Index (RSI)

Method: identify overbought and oversold conditions.

When the RSI crosses above 30 from below, this is a good indicator to buy. When the RSI crosses below 70 from above, this is a good indicator to sell.

Combining Indicators for Enhanced Scalping

Combining these indicators can improve the accuracy of your scalping strategy as no method is flawless.

For example, a strategy could be:

- Identify the Trends using the Moving Average Ribbon Entry Strategy

- Enter with signals using the Stochastic Oscillator – when the %K crosses the %D in the direction of the identified trend.

- Exit the trade if the price touches the opposite Bollinger Band (or when the Stochastic Oscillator Reverses).

- For additional confirmation, you could examine the RSI and see if that supports the trend direction. Try to avoid the overbought conditions for buys and oversold for sells.

Adapting to Modern Market Conditions

Adapting to the current market conditions is crucial for effective forex scalping. Today’s markets are fast paced and contain lots of fluctuating data, making it essential to use indicators that perform well during strong trending or range-bound actions.

These indicators, such as moving averages, Bollinger Bands, and the stochastic oscillator, are the most effective when the market is showing a clear direction of movement or stable price ranges. They are less effective during periods of market consolidation, conflict, or confusion, where price movements are erratic and harder to predict.

Successful scalping involves a constant monitoring of the market and the flexibility to adjust strategies based on the current conditions.

Conclusion

Scalping requires immense focus and involves quick decision-making, precision, and the use of reliable technical indicators. Through maintaining discipline, practice and learning, traders can develop a robust scalping strategy. While no strategy will be perfect and still entail losses, constantly reviewing and adapting strategies through time and practice will reduce risk and further increase your chances of success in the world of forex scalping.